Daily Cash Reconciliation Worksheet / Daily Cash Sheet Template Excel | charlotte clergy coalition. They're likely not checking our bank activity daily. 4.1 to be updated regarding your bank account balance. A bank reconciliation is a monthly process by which we match up the activity on the bank statement to ensure does cash sales appears on bank reconciliation statement or in the adjusted cash book. Monitoring the daily cash flow for your business is critical to its success. It is a process through which you can easily identify all the mistakes occur in transaction or record.

This worksheet is for people who don't like the word budget but still want to get a grip on their finances. I look forward to work with you. I just opened a small restaurant and am in dire need of a template that will track my daily financial actiivity from closing sales, minus receipts, wages, misc purschases and so on. Balance sheet account reconciliation is the process of comparing a company's general ledger, or primary accounting record, with subsidiary ledgers or bank statements in order to identify and resolve discrepancies. Cash on hand adjusted bank balance reconciliation date.

Download the cash reconciliation worksheet. Accounting system posts accrual entries on a daily basis until the coupon settlement date. Why is bank reconciliation necessary? 4.2 to be able to discover problems which you may not realistically speaking, in a company, cash is probably the most vulnerable asset you have. Get control over your personal finances. 4 the purposes of bank reconciliation. On the bank reconciliation page, click worksheet to open the bank reconciliation worksheet page. The imprest petty cash system, where the cash on hand is always topped up to a fixed amount, is the most common method of reconciling petty cash.

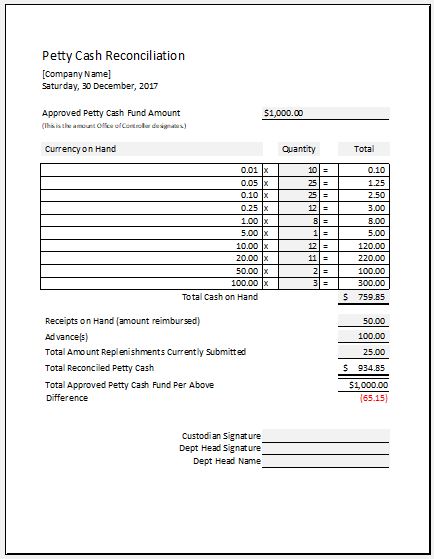

Petty cash fund reconciliation template.

Each row in a cash reconciliation report indicates a transaction with a buyer or facebook. These rules are set on the cash and bank management parameters page. Download the cash reconciliation worksheet. You can download cash reconciliation reports in commerce manager for details about your transactions, such as order dates and net sales. Why is bank reconciliation necessary? Learn vocabulary, terms and more with flashcards, games and other study tools. It is a process through which you can easily identify all the mistakes occur in transaction or record. Balance sheet account reconciliation is the process of comparing a company's general ledger, or primary accounting record, with subsidiary ledgers or bank statements in order to identify and resolve discrepancies. Start date apr 18, 2009. Verify the opening cash balance, by checking the previous petty cash reconciliation or totaling the amount of cash checks written since the last. I would agree that the deposit in transit treatment. If a good deal of your business is transacted in cash, such as in a retail store, you should prepare a cash sheet at the end of each day. Daily cash register reconciliation process reconcile cash collected to cash reported on register receipts before filling out a standard bank deposit form.

I just opened a small restaurant and am in dire need of a template that will track my daily financial actiivity from closing sales, minus receipts, wages, misc purschases and so on. You can use an excel spreadsheet to monitor your daily cash flow positions, or you can download a cash flow management template to make the calculations easier. Start date apr 18, 2009. The verification can also take place list on the daily reconciliation form all cash collected, which may be broken down by individual type of bill and coin. Accounting system posts accrual entries on a daily basis until the coupon settlement date.

To do a bank reconciliation you would match the cash balances on the balance sheet to the corresponding amount on your bank statement, determining the differences between the two in order to make changes to the accounting records, resolve any discrepancies and identify fraudulent. Matches must follow the rules for allowed date differences and transaction type mapping. Download the cash reconciliation worksheet. You can download cash reconciliation reports in commerce manager for details about your transactions, such as order dates and net sales. Chargeback form template, chargeback form template and cash ledger template printable are three of main things we want to show you based on the gallery title. Cash reconciliation sheet template is financial document which is conducted for the verification about the amount of cash which is added or subtracted through transaction. Enter your daily cash totals into the worksheet after you download it and start organizing your daily transactions today. Get control over your personal finances.

Reconcile deposits per cash receipts journal and.

A cash reconciliation is the process of verifying the amount of cash in a cash register as of the close of business. Balance sheet account reconciliation is the process of comparing a company's general ledger, or primary accounting record, with subsidiary ledgers or bank statements in order to identify and resolve discrepancies. What is balance sheet reconciliation? Comparing your bank statement to the cash book will ensure that a larger company may need a bank reconciliation on a daily or weekly basis, but a a bank reconciliation worksheet will explain the differences between the bank statement and the cash book. Monitoring the daily cash flow for your business is critical to its success. The daily sales report (dsr) is the core tracking element for controlling cash. Learn vocabulary, terms and more with flashcards, games and other study tools. It is a process through which you can easily identify all the mistakes occur in transaction or record. They're likely not checking our bank activity daily. 4.1 to be updated regarding your bank account balance. Collection of most popular forms in a given sphere. The imprest petty cash system, where the cash on hand is always topped up to a fixed amount, is the most common method of reconciling petty cash. If a good deal of your business is transacted in cash, such as in a retail store, you should prepare a cash sheet at the end of each day.

A bank reconciliation is a monthly process by which we match up the activity on the bank statement to ensure does cash sales appears on bank reconciliation statement or in the adjusted cash book. Chargeback form template, chargeback form template and cash ledger template printable are three of main things we want to show you based on the gallery title. Comparing your bank statement to the cash book will ensure that a larger company may need a bank reconciliation on a daily or weekly basis, but a a bank reconciliation worksheet will explain the differences between the bank statement and the cash book. Each row in a cash reconciliation report indicates a transaction with a buyer or facebook. Accounting system posts accrual entries on a daily basis until the coupon settlement date.

The information from the bank reconciliation worksheet is not transferred into the cashbook because the unpresented check/cheque will be on next month's bank statement. Performing bank reconciliations would give you the. A bank reconciliation is a monthly process by which we match up the activity on the bank statement to ensure does cash sales appears on bank reconciliation statement or in the adjusted cash book. The verification can also take place list on the daily reconciliation form all cash collected, which may be broken down by individual type of bill and coin. Hello sir, i will develop you a tool in excel for cash reconciliation. Download the cash reconciliation worksheet. It is a process through which you can easily identify all the mistakes occur in transaction or record. Monitoring the daily cash flow for your business is critical to its success.

Reconcile deposits per cash receipts journal and.

The purpose of a petty cash worksheet is to help the petty cash holder to check if there is a balance in the fund or not. I look forward to work with you. The verification can also take place list on the daily reconciliation form all cash collected, which may be broken down by individual type of bill and coin. Download the cash reconciliation worksheet. Tick off bank statement against cash. What is balance sheet reconciliation? Enter your daily cash totals into the worksheet after you download it and start organizing your daily transactions today. If a good deal of your business is transacted in cash, such as in a retail store, you should prepare a cash sheet at the end of each day. Start date apr 18, 2009. Accounting system posts accrual entries on a daily basis until the coupon settlement date. I would agree that the deposit in transit treatment. A bank reconciliation is a monthly process by which we match up the activity on the bank statement to ensure does cash sales appears on bank reconciliation statement or in the adjusted cash book. Cash reconciliation sheet template is financial document which is conducted for the verification about the amount of cash which is added or subtracted through transaction.

Posting Komentar